Basic cancer plans pay for all of the following EXCEPT: O A. immunotherapy O B. chemotherapy O. C. physical therapy O D. radiotherapy Understanding Business 12th Edition ISBN: 9781259929434 Author: William Nickels Publisher: William Nickels Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment Section: Chapter Questions

High Blood Pressure (Hypertension): Symptoms and More

Many cancer insurance policies have fixed dollar limits. For example, a policy might pay only up to $1,500 for surgery costs or $1,000 for radiation therapy, or it might have fixed payments, such as $50 or $100 for each day in the hospital. Others limit total benefits to a fixed amount, such as $5,000 or $10,000.

Source Image: health.harvard.edu

Download Image

1. The point of cancer insurance is to reduce the price of cancer treatment. Cancer insurance isn’t supposed to replace the benefits provided by your primary health insurance. Cancer insurance is supposed to help you pay some of the expenses your basic policy doesn’t cover. 2. Cancer insurance policies can cover a lot of costs.

Source Image: health.harvard.edu

Download Image

The benefits of AI in healthcare – IBM Blog

Mar 1, 2023For more, NCI’s database, Organizations That Offer Support Services, contains lists of organizations that offer emotional, practical, and financial support. You can also call NCI’s Cancer Information Service at 1-800-4-CANCER (1-800-422-6237) to ask for help finding referrals and resources.

Source Image: singaporecancersociety.org.sg

Download Image

Basic Cancer Plans Pay For All Of The Following Except

Mar 1, 2023For more, NCI’s database, Organizations That Offer Support Services, contains lists of organizations that offer emotional, practical, and financial support. You can also call NCI’s Cancer Information Service at 1-800-4-CANCER (1-800-422-6237) to ask for help finding referrals and resources.

Catastrophic insurance does pay for the following, regardless of how much of your deductible you’ve paid: Three primary care visits a year Preventive services required under the Affordable Care Act (ACA) including some screening tests and vaccinations

Cancer Basics

With most plans, if you’ve been diagnosed with cancer, you will receive a lump sum of money you can use for both medical costs and normal living expenses. You essentially use the money any way you choose to make up for lost wages, deductibles, and co-pays. Less commonly, a policy may provide coverage for cancer-related expenses above and beyond

U Care Fund – Step by Step Guide_Cash_2022_R2_FA

Source Image: ntuc.org.sg

Download Image

Overall Cancer Statistics – Annual Report to the Nation

With most plans, if you’ve been diagnosed with cancer, you will receive a lump sum of money you can use for both medical costs and normal living expenses. You essentially use the money any way you choose to make up for lost wages, deductibles, and co-pays. Less commonly, a policy may provide coverage for cancer-related expenses above and beyond

Source Image: seer.cancer.gov

Download Image

High Blood Pressure (Hypertension): Symptoms and More

1. The point of cancer insurance is to reduce the price of cancer treatment. Cancer insurance isn’t supposed to replace the benefits provided by your primary health insurance. Cancer insurance is supposed to help you pay some of the expenses your basic policy doesn’t cover. 2. Cancer insurance policies can cover a lot of costs.

Source Image: healthline.com

Download Image

The benefits of AI in healthcare – IBM Blog

Basic cancer plans pay for all of the following EXCEPT: O A. immunotherapy O B. chemotherapy O. C. physical therapy O D. radiotherapy Understanding Business 12th Edition ISBN: 9781259929434 Author: William Nickels Publisher: William Nickels Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment Section: Chapter Questions

Source Image: ibm.com

Download Image

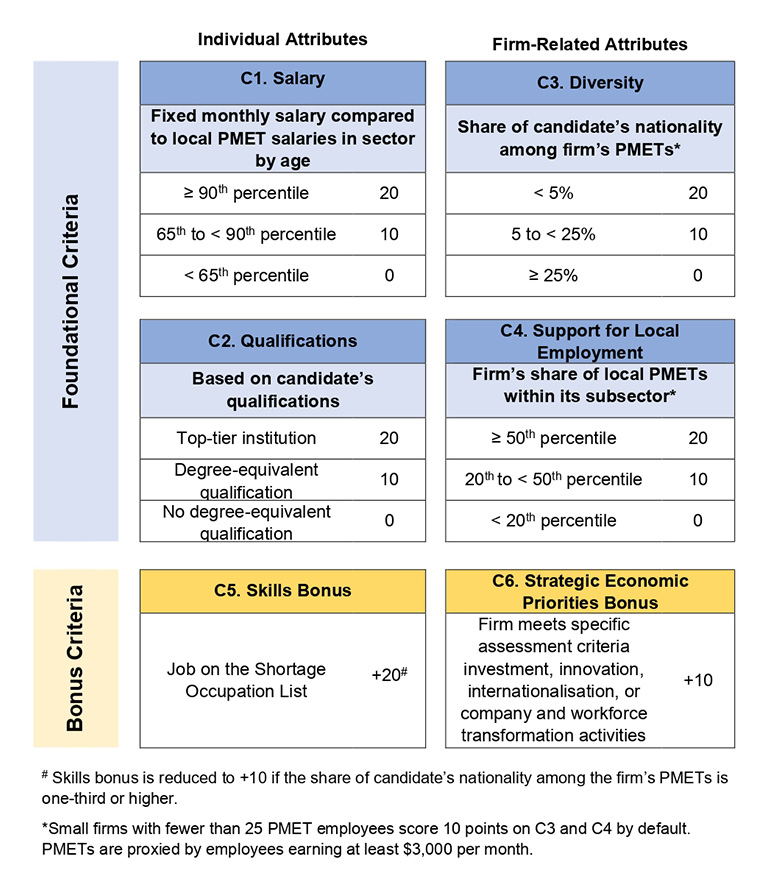

Singapore’s Employment Pass – All you need to know about the Complementarity Assessment Framework | Singapore EDB

HMOs, PPOs, POS plans, and EPOs are all kinds of managed care plans. Here are some of the differences between managed care plans Health maintenance organizations (HMOs) offer lower monthly premiums and out-of-pocket costs. However, they are less flexible with a smaller network of providers to choose from.

Source Image: edb.gov.sg

Download Image

Everything you need to know about Medicare reforms – PAN Foundation

Mar 1, 2023For more, NCI’s database, Organizations That Offer Support Services, contains lists of organizations that offer emotional, practical, and financial support. You can also call NCI’s Cancer Information Service at 1-800-4-CANCER (1-800-422-6237) to ask for help finding referrals and resources.

Source Image: panfoundation.org

Download Image

Life Insurance: What It Is, How It Works, and How To Buy a Policy

Catastrophic insurance does pay for the following, regardless of how much of your deductible you’ve paid: Three primary care visits a year Preventive services required under the Affordable Care Act (ACA) including some screening tests and vaccinations

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png)

Source Image: investopedia.com

Download Image

Overall Cancer Statistics – Annual Report to the Nation

Life Insurance: What It Is, How It Works, and How To Buy a Policy

Many cancer insurance policies have fixed dollar limits. For example, a policy might pay only up to $1,500 for surgery costs or $1,000 for radiation therapy, or it might have fixed payments, such as $50 or $100 for each day in the hospital. Others limit total benefits to a fixed amount, such as $5,000 or $10,000.

The benefits of AI in healthcare – IBM Blog Everything you need to know about Medicare reforms – PAN Foundation

HMOs, PPOs, POS plans, and EPOs are all kinds of managed care plans. Here are some of the differences between managed care plans Health maintenance organizations (HMOs) offer lower monthly premiums and out-of-pocket costs. However, they are less flexible with a smaller network of providers to choose from.