The Fair Credit Reporting Act (FCRA) is a law that protects consumers when it comes to challenges over the accuracy of their credit files. The law provides, among other things, that when a credit bureau receives notice of a dispute it must reasonably investigate the claims. The investigation must be performed within 30 days.

An Introduction to ChexSystems – QFinance

Mar 17, 2023Featured topic. On March 17, 2023, the CFPB published an updated version of the Summary of Consumer Rights pursuant to the Updated and Corrected Agency Contact Information Rule.The updates were made to both the English and Spanish versions. In July 2021, the CFPB issued a COVID-19-related FCRA Enforcement Compliance Bulletin regarding consumer rental information, and in June 2020, the CFPB

Source Image: halladvisory.com

Download Image

Re: Dispute Results “meets FCRA requirements“. @RobertEG wrote: “Meets FCRA requirments” means that the dispute was resolved, either by verification of the accuracy of the disputed information or by correction of the reported information so as to overcome any agreed inaccuracy. Resolution of a dispute does not necessarily mean that the debt is

.png)

Source Image: blogs.vakilkaro.com

Download Image

How to track when someone forwards my email – Quora After logging into CK and viewing my accounts, I noticed a remark was added to one of my USAA accounts. The remark says “Consumer disputes this account information“. And on my Transunion report it says “Account information disputed by consumer, meets FCRA requirements“. Does anyone know what this actually means?

Source Image: lemon8-app.com

Download Image

Account Information Disputed By Consumer Meets Fcra Requirements Reddit

After logging into CK and viewing my accounts, I noticed a remark was added to one of my USAA accounts. The remark says “Consumer disputes this account information“. And on my Transunion report it says “Account information disputed by consumer, meets FCRA requirements“. Does anyone know what this actually means? Apr 2, 2022Specifically, the FCRA requires credit furnishers to: Follow reasonable procedures to ensure the accuracy of the information in your report. Additionally, it also spells out your rights as a consumer, like the right to dispute information on your credit report. However, just because the credit bureau claims that your information meets FCRA

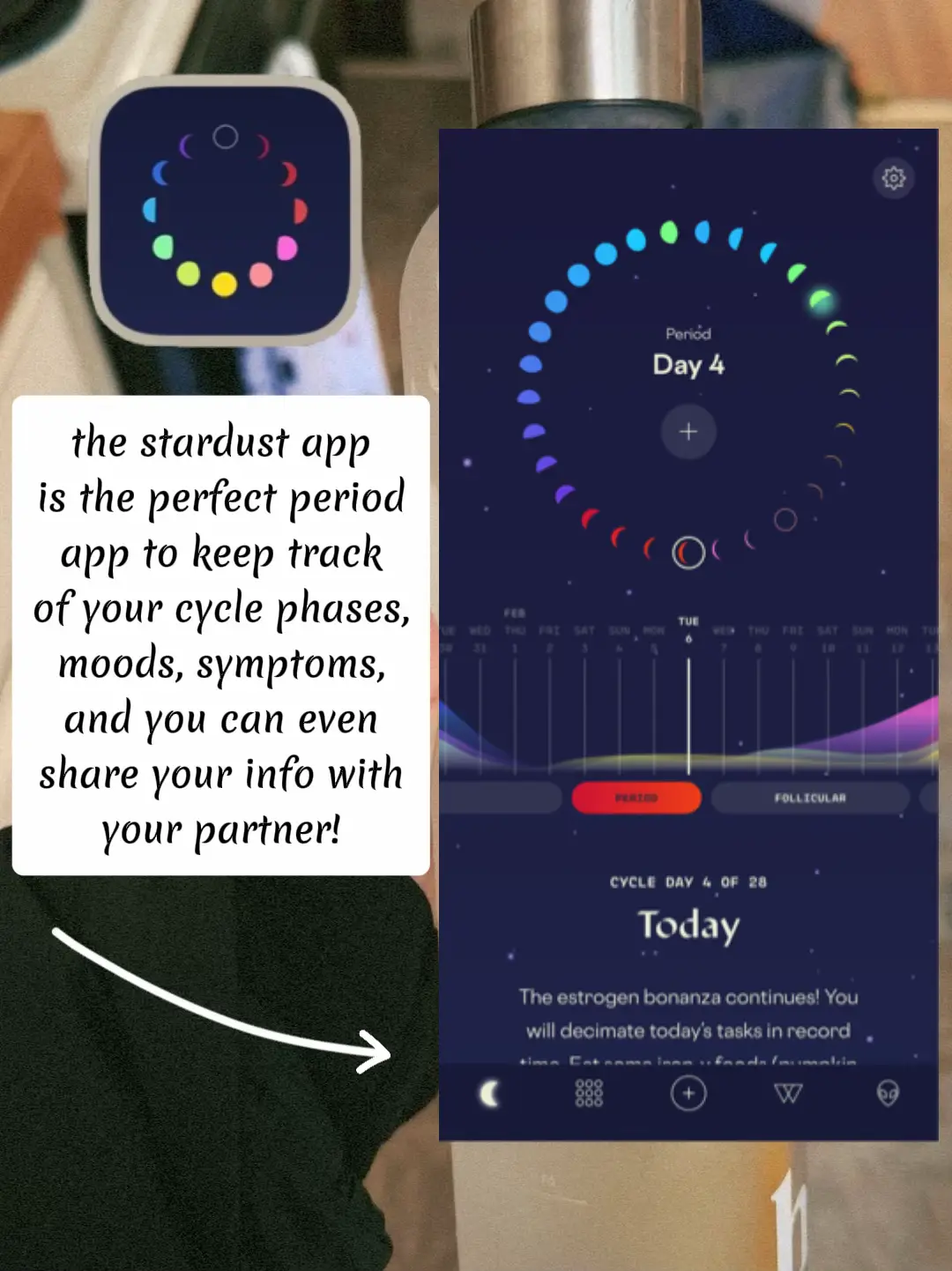

First Time Buy Iphone – Lemon8 Search

Account Information Disputed by Consumer, Meets FCRA requirements – Credit Karma (Collections) About 6 years ago today (9/23/2023) I went to an emergency room and had to get scanned. Initially they wanted me to pay $10k for the simple scan with no insurance. Review of the Social Security Tribunal of Canada – Canada.ca

Source Image: canada.ca

Download Image

DIGITAL EXHAUST OPT OUT GUIDE Account Information Disputed by Consumer, Meets FCRA requirements – Credit Karma (Collections) About 6 years ago today (9/23/2023) I went to an emergency room and had to get scanned. Initially they wanted me to pay $10k for the simple scan with no insurance.

Source Image: investigators-toolbox.com

Download Image

An Introduction to ChexSystems – QFinance The Fair Credit Reporting Act (FCRA) is a law that protects consumers when it comes to challenges over the accuracy of their credit files. The law provides, among other things, that when a credit bureau receives notice of a dispute it must reasonably investigate the claims. The investigation must be performed within 30 days.

Source Image: qfinance.com

Download Image

How to track when someone forwards my email – Quora Re: Dispute Results “meets FCRA requirements“. @RobertEG wrote: “Meets FCRA requirments” means that the dispute was resolved, either by verification of the accuracy of the disputed information or by correction of the reported information so as to overcome any agreed inaccuracy. Resolution of a dispute does not necessarily mean that the debt is

Source Image: quora.com

Download Image

For the Nier/Drakengard fans. Cult of the Watchers symbol : r/armoredcore r/personalfinance. • 5 yr. ago. LiftsLikeGaston. “Account information disputed by consumer, meets FCRA requirements. “. Credit. Hi all, So I got a surprise collection account on my credit report and filed a dispute for it. This remark is now showing under that collections account in my report.

Source Image: reddit.com

Download Image

Ticket: # 1227953 – Spam advertisement emails Description After logging into CK and viewing my accounts, I noticed a remark was added to one of my USAA accounts. The remark says “Consumer disputes this account information“. And on my Transunion report it says “Account information disputed by consumer, meets FCRA requirements“. Does anyone know what this actually means?

Source Image: fcc.gov

Download Image

Implement the Serialization of a Passport User (Database connection should be present (Cannot find what i did Wrong)) – JavaScript – The freeCodeCamp Forum Apr 2, 2022Specifically, the FCRA requires credit furnishers to: Follow reasonable procedures to ensure the accuracy of the information in your report. Additionally, it also spells out your rights as a consumer, like the right to dispute information on your credit report. However, just because the credit bureau claims that your information meets FCRA

Source Image: forum.freecodecamp.org

Download Image

DIGITAL EXHAUST OPT OUT GUIDE

Implement the Serialization of a Passport User (Database connection should be present (Cannot find what i did Wrong)) – JavaScript – The freeCodeCamp Forum Mar 17, 2023Featured topic. On March 17, 2023, the CFPB published an updated version of the Summary of Consumer Rights pursuant to the Updated and Corrected Agency Contact Information Rule.The updates were made to both the English and Spanish versions. In July 2021, the CFPB issued a COVID-19-related FCRA Enforcement Compliance Bulletin regarding consumer rental information, and in June 2020, the CFPB

How to track when someone forwards my email – Quora Ticket: # 1227953 – Spam advertisement emails Description r/personalfinance. • 5 yr. ago. LiftsLikeGaston. “Account information disputed by consumer, meets FCRA requirements. “. Credit. Hi all, So I got a surprise collection account on my credit report and filed a dispute for it. This remark is now showing under that collections account in my report.