A qualified disaster distribution is an amount up to $100,000 taken by a participant whose main home was in the federally declared disaster area and the distribution was made for: Harvey, after August 22, 2017, and before January 1, 2019; Irma, after September 3, 2017, and before January 1, 2019;

Leveraging social media during a disaster

At any time between the first day of the Incident Period and December 21, 2020, the trade or business within the Qualified Disaster Zone became “inoperable”, as a result of damage sustained by

Source Image: visualcapitalist.com

Download Image

You made a repayment in 2020 of qualified 2017 disaster distribution amounts from line 10 of 2018 Form 8915B; or line 8 of 2017 Form 8915B. Line 5. At any time during the 3-year period beginning 1 day after the date you received a qualified 2017 disaster distribution, you can repay any portion of the distribution to an

Source Image: marca.com

Download Image

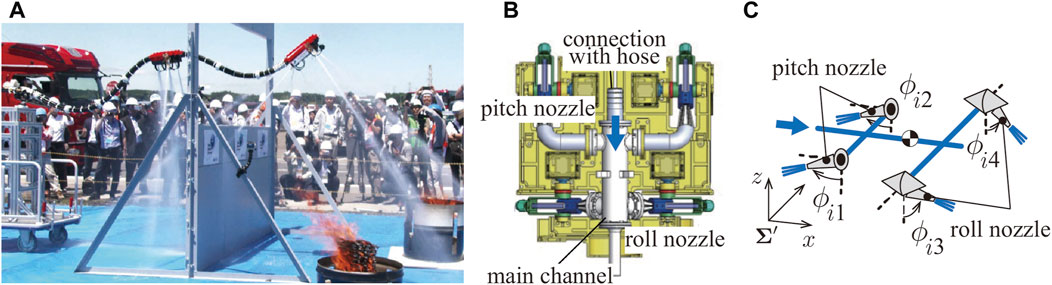

Frontiers | Development of a remotely controllable 4 m long aerial-hose-type firefighting robot Feb 24, 2022Forms 8915-B, 8915-C, and 8915-D (relating to qualified 2017, 2018, and 2019 disasters, respectively) have been updated for 2021. The 2021 revision is the last revision of Form 8915-B. Form 8915-A (qualified 2016 disasters) has not been updated; the 2020 revision is the last version of that form. … (covering 2021 through 2024 reporting for

Source Image: pbs.org

Download Image

Disaster Distribution At Any Time Between 2018 And 2020

Feb 24, 2022Forms 8915-B, 8915-C, and 8915-D (relating to qualified 2017, 2018, and 2019 disasters, respectively) have been updated for 2021. The 2021 revision is the last revision of Form 8915-B. Form 8915-A (qualified 2016 disasters) has not been updated; the 2020 revision is the last version of that form. … (covering 2021 through 2024 reporting for Jan 29, 2021For example, if you took an eligible distribution of $75,000, you could elect to report the entire amount on your 2020 tax return or choose to report $25,000 on each of your 2020, 2021, and 2022

African officials lay out goals ahead of the U.N. climate summit | PBS NewsHour

Part I. Use Part I to figure your: Total distributions from all retirement plans (including IRAs), Qualified 2020 disaster distributions, and Distributions other than qualified 2020 disaster distributions. If you need to complete Part I of 2020 Form 8915-C or Form 8915-D, complete those forms first. Parts II and III. Use Parts II and III to: Death toll rises to 89 in Hawaii, making it the deadliest wildfire in modern U.S. history

Source Image: nbcnews.com

Download Image

Online Fire & Emergency Services Administration Degree | CSU Online Part I. Use Part I to figure your: Total distributions from all retirement plans (including IRAs), Qualified 2020 disaster distributions, and Distributions other than qualified 2020 disaster distributions. If you need to complete Part I of 2020 Form 8915-C or Form 8915-D, complete those forms first. Parts II and III. Use Parts II and III to:

Source Image: online.colostate.edu

Download Image

Leveraging social media during a disaster A qualified disaster distribution is an amount up to $100,000 taken by a participant whose main home was in the federally declared disaster area and the distribution was made for: Harvey, after August 22, 2017, and before January 1, 2019; Irma, after September 3, 2017, and before January 1, 2019;

Source Image: news.uga.edu

Download Image

Frontiers | Development of a remotely controllable 4 m long aerial-hose-type firefighting robot You made a repayment in 2020 of qualified 2017 disaster distribution amounts from line 10 of 2018 Form 8915B; or line 8 of 2017 Form 8915B. Line 5. At any time during the 3-year period beginning 1 day after the date you received a qualified 2017 disaster distribution, you can repay any portion of the distribution to an

Source Image: frontiersin.org

Download Image

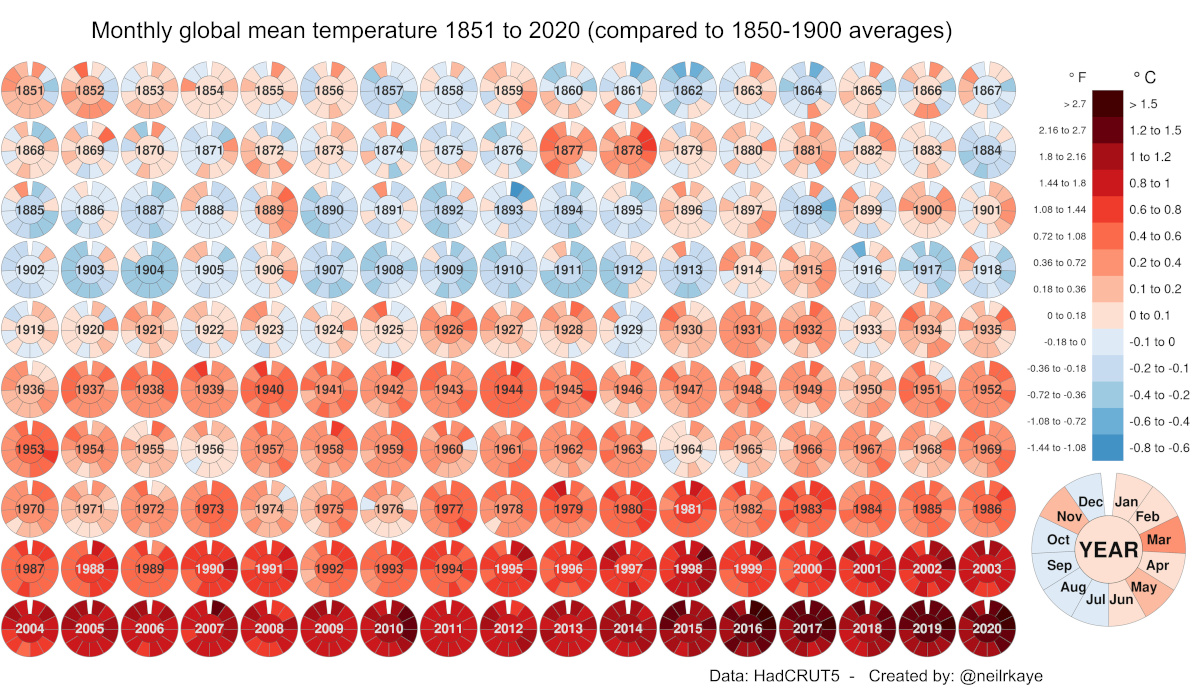

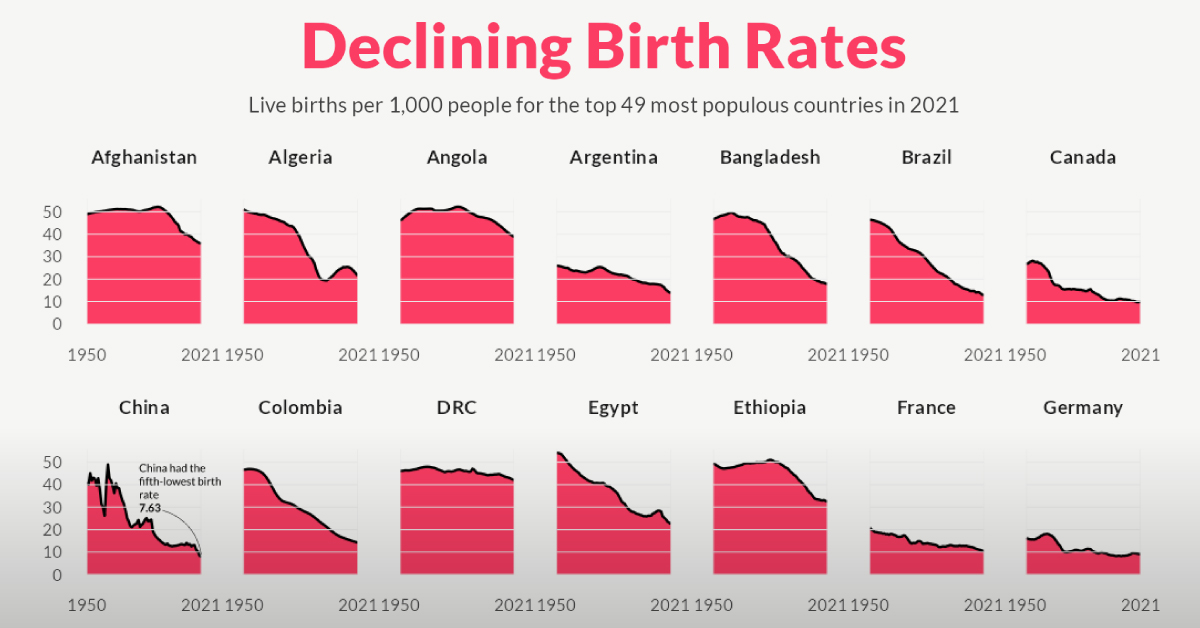

Charted: The Rapid Decline of Global Birth Rates For example, qualified 2016 disaster distributions were permitted through December 31, 2017, and a qualified 2016 disaster distribution made in December 2017 could be repaid as late as December 2020. While the Form 8915-series reporting burden does not fall on employers or plan administrators, both may find it useful to be familiar with the

Source Image: visualcapitalist.com

Download Image

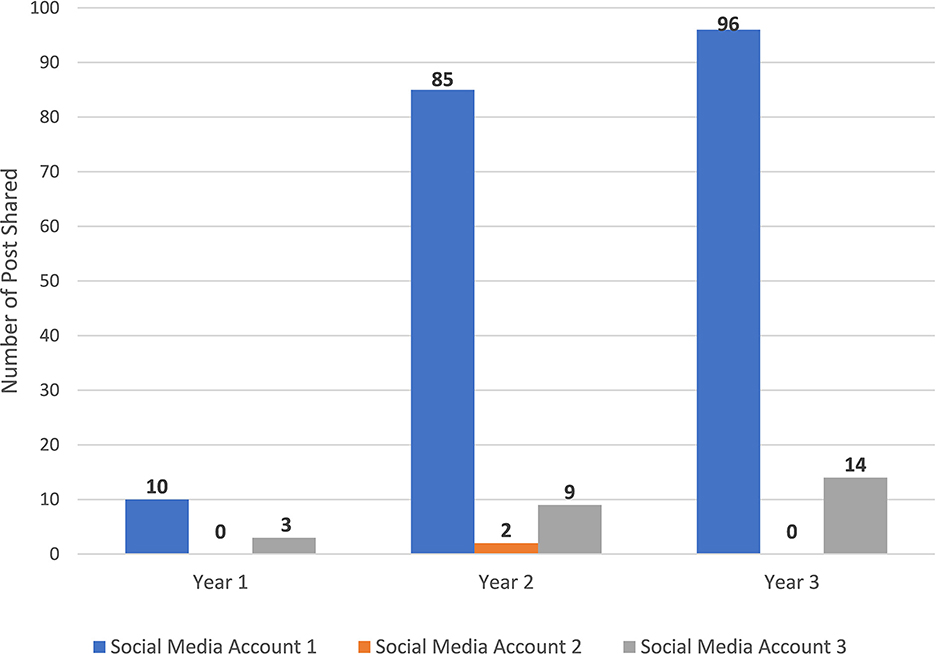

Frontiers | Maternal health posts shared on Instagram: a content analysis of popular birthing and parenting accounts Feb 24, 2022Forms 8915-B, 8915-C, and 8915-D (relating to qualified 2017, 2018, and 2019 disasters, respectively) have been updated for 2021. The 2021 revision is the last revision of Form 8915-B. Form 8915-A (qualified 2016 disasters) has not been updated; the 2020 revision is the last version of that form. … (covering 2021 through 2024 reporting for

Source Image: frontiersin.org

Download Image

Nepal earthquakes: Facts, FAQs, and how to help | World Vision Jan 29, 2021For example, if you took an eligible distribution of $75,000, you could elect to report the entire amount on your 2020 tax return or choose to report $25,000 on each of your 2020, 2021, and 2022

Source Image: worldvision.org

Download Image

Online Fire & Emergency Services Administration Degree | CSU Online

Nepal earthquakes: Facts, FAQs, and how to help | World Vision At any time between the first day of the Incident Period and December 21, 2020, the trade or business within the Qualified Disaster Zone became “inoperable”, as a result of damage sustained by

Frontiers | Development of a remotely controllable 4 m long aerial-hose-type firefighting robot Frontiers | Maternal health posts shared on Instagram: a content analysis of popular birthing and parenting accounts For example, qualified 2016 disaster distributions were permitted through December 31, 2017, and a qualified 2016 disaster distribution made in December 2017 could be repaid as late as December 2020. While the Form 8915-series reporting burden does not fall on employers or plan administrators, both may find it useful to be familiar with the